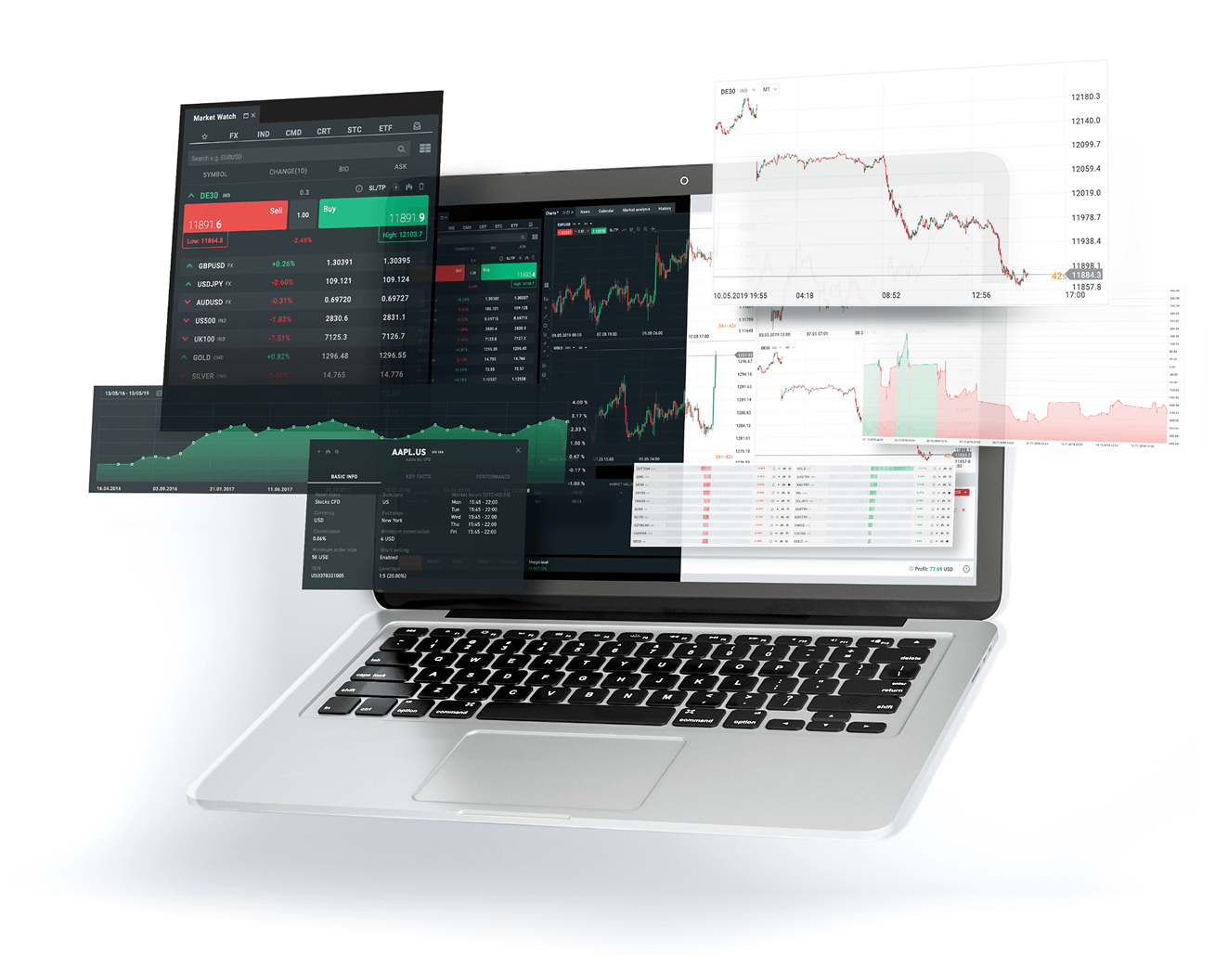

FX AND CFD LIQUIDITY PROVIDER

Our multi-asset liquidity comes equipped with advanced capabilities and features, helping our partners to maximise product offering and diversify revenue streams with our safe, secure and reliable pricing.

Book a meeting