Multi-asset Liquidity

For Banks and Brokers

X Open Hub is a global provider of institutional liquidity and trading infrastructure, trusted by banks, brokers, and fintechs worldwide (professional clients). As part of the XTB Group, with over 20 years of market expertise, we combine financial strength with cutting-edge technology. Our mission is to empower institutions with deep liquidity, and reliable infrastructure. We go beyond standard solutions - delivering innovation, transparency, and tailored services that help our partners scale and succeed. We focus on creating enduring relationships built on openness, reliability, and collective growth.

US STAND OUT

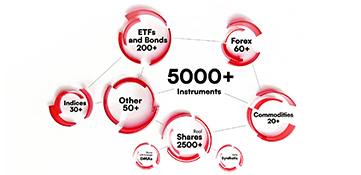

Access deep institutional liquidity on 5,000+ instruments, including forex, cryptocurrencies, indices, commodities, shares, and ETFs. This broad multi-asset coverage helps brokers and banks enhance and diversify their product offering.

Our infrastructure includes colocated servers in leading global data centers, delivering low-latency execution and stable connectivity for institutional trading flows.

Access aggregated order book data via FIX protocol or trading terminals, with reliable market depth and consistent pricing across multiple asset classes.

X Open Hub is part of the WSE-listed XTB S.A. capital group. The capital group operates under the supervision of leading regulators, including KNF, CySEC, DFSA, FSCA, FSC, FCA, FSA, and SCA.

Connectivity options include FIX protocol, API, and MT4/MT5 Bridge or Gateway. We are integrated with PrimeXM, oneZero, Gold-i, Tools for Brokers, Match-Trade, and other leading technology providers.

Intuitive back-office tools with advanced reporting, margin notifications, and exposure monitoring help brokers manage risk and protect their book more effectively.

More than 100 companies in over 30 countries across the globe rely on X Open Hub to grow their business. Since 2010, we have been providing assistance to our customers and we have been advising clients on the best solution for their brokerages.

Deep institutional liquidity

on 5000+ global instruments

Here you can see the most traded financial instruments among our wide liquidity offering. Check our deep liquidity on forex, indices, cryptocurriences, commodities, shares and ETFs.

See More

Our liquidity solution comes equipped with advanced capabilities and features, helping you to maximize your profit and diversify your revenue streams.

Learn more

We provide a complete front & back end technology and to help you convert your IB business or White Label into your own fully branded, customized brokerage.

Learn more