FOREX WHITE LABEL PROGRAM

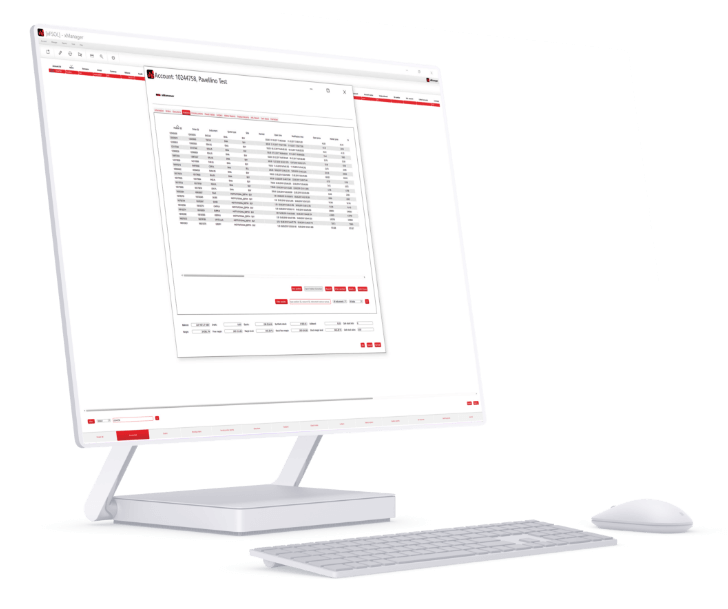

X Open Hub provides a complete front & back end technology and liquidity solution to help you convert your IB business or White Label into your own fully branded, customised brokerage and realise more profits.

Even if you aren't an IB or White label, we can help you get started with an express start up package.